ri tax rate income

Rhode Island Income Taxes. Rhode Island has a.

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 17 2023.

. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of. Census Bureau Number of cities that have local income taxes. Our Rhode Island retirement tax friendliness calculator can help you estimate your tax burden in retirement using your Social Security 401k and IRA income.

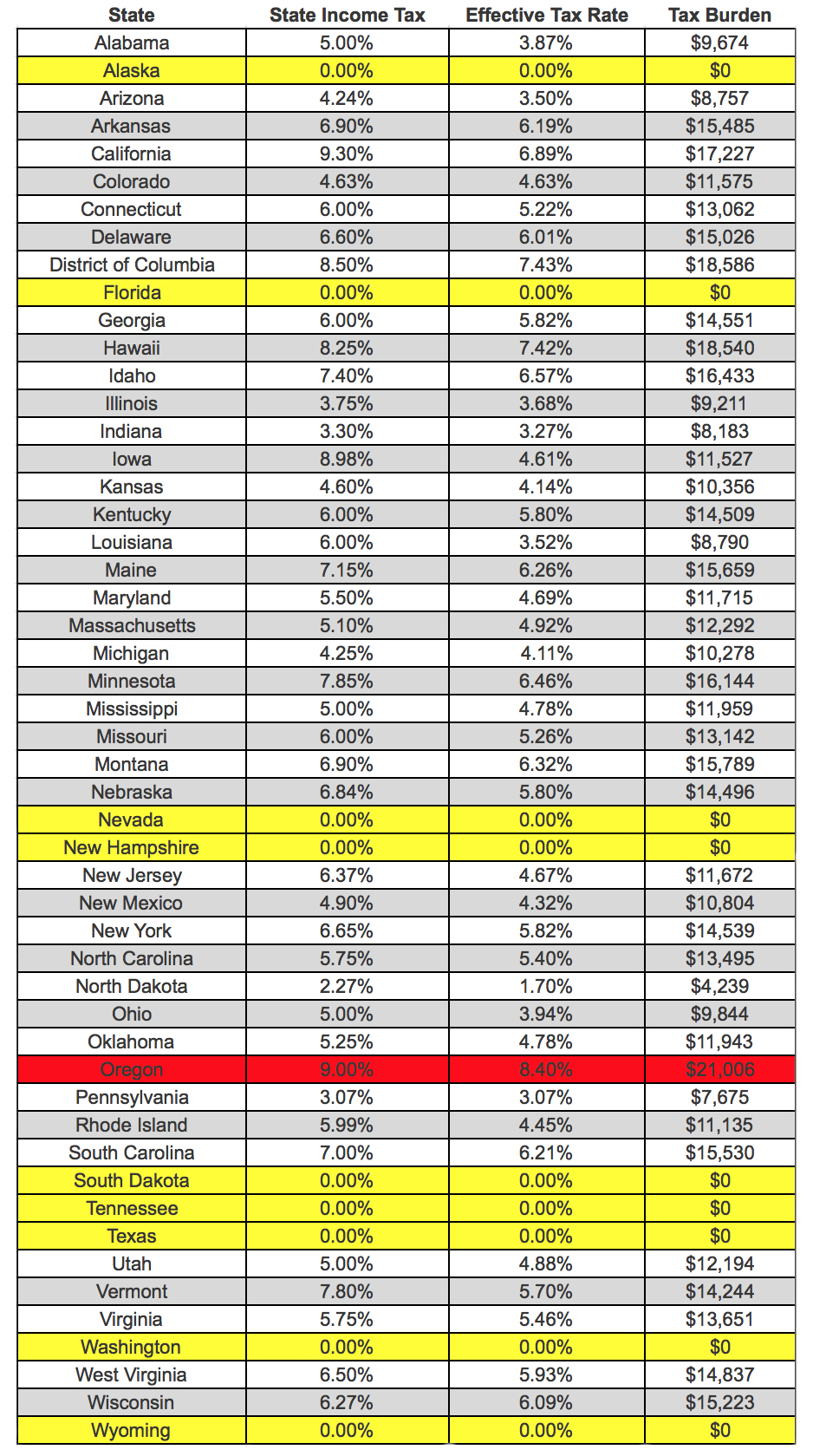

Rhode Islands 2022 income tax ranges from 375 to 599. Rhode Island Income Tax Calculator 2021. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Ad Access Tax Forms. The Rhode Island LLC tax for C corporations is a flat rate of 7 percent as of 2018 with a minimum business corporation tax of 400. To calculate the Rhode Island taxable income the statute starts with Federal taxable income.

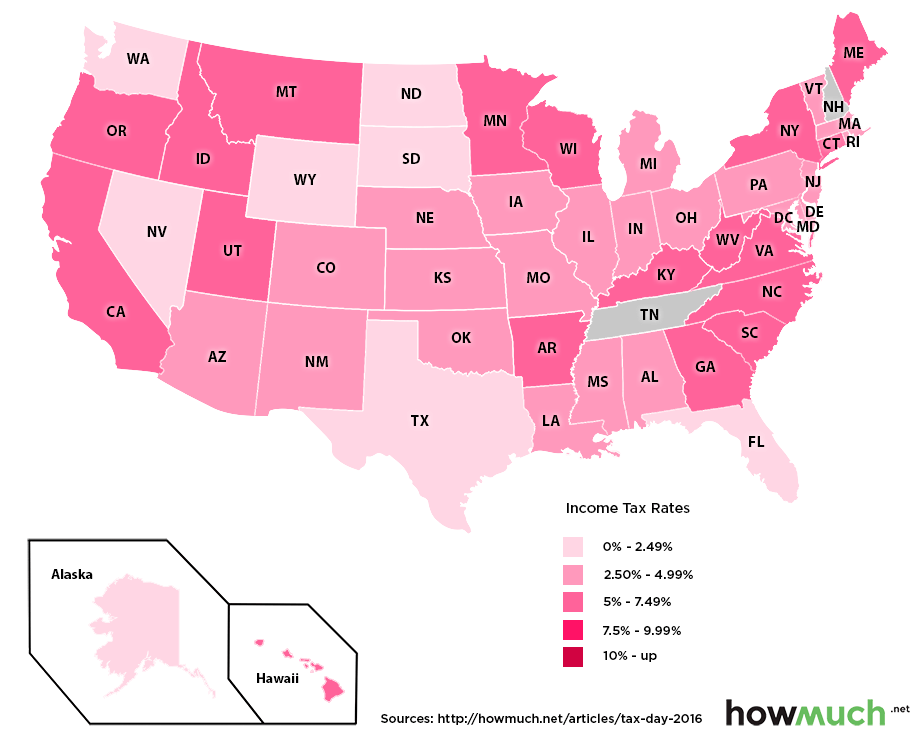

How Your Rhode Island Paycheck. Discover Helpful Information And Resources On Taxes From AARP. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income.

Rhode Island Corporate Income tax is assessed at the rate of 7 of Rhode Island taxable income. The table below shows the. DO NOT use to figure your Rhode Island tax.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Detailed Rhode Island state income tax rates and brackets are available on. Ad Be the First to Know when Rhode Island Tax Developments Impact Your Business or Clients.

DO NOT use to figure your Rhode Island tax. The range where your annual income. Rhode Island Tax Table.

Your 2021 Tax Bracket To See Whats Been Adjusted. Each tax bracket corresponds to an income range. Also as of 2018 the minimum business corporation tax.

In order to be eligible for the Child Tax Rebate please remember to file your tax year 2021 Personal Income Tax Return by August 31 2022 or if you have filed an extension by the. Instead if your taxable income. Up to 25 cash back Under Rhode Islands business corporation tax as of 2018 C corporation income is taxed at a flat rate of 70.

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates.

Rhode Island income tax rate. For the 2022 tax year homeowners 65 and older with household income of 35000 or less can get a state income tax credit of up. Ad Compare Your 2022 Tax Bracket vs.

In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate. As an example consider a Rhode Island business that had a. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator.

Personal Income Tax RI Division of Taxation. Rhode Island Property Tax Breaks for Retirees. Any income over 150550 would be.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Complete Edit or Print Tax Forms Instantly. Rhode Island Income Tax Rate 2022 - 2023.

Rhode Island Tax Brackets for Tax Year 2021. Download Or Email RI-1040NR More Fillable Forms Register and Subscribe Now. Your average tax rate is 1198 and your.

Bloomberg Tax Expert Analysis Your Comprehensive Rhode Island Tax Information Resource. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081. Rhode Island also has a 700 percent corporate income tax rate.

Rhode Island uses a progressive tax system with three different tax brackets ranging from 375-599.

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets Tax Foundation

Rhode Island Estate Tax Everything You Need To Know Smartasset

Rhode Island State Economic Profile Rich States Poor States

If Doctors Chose Their Job Locations Based On State Income Taxes Passive Income M D

Which U S States Have The Lowest Income Taxes

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

State Income Tax Rates Highest Lowest 2021 Changes

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Income Tax Brackets 2020

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

Historical Rhode Island Tax Policy Information Ballotpedia