when are property taxes due in lake county illinois

If approved by voters the property tax would be 1 for every 1000 of assessed property value. Lake County Journal.

Estimated Effective Property Tax Rates 2009 2018 Selected Municipalities In Northeastern Illinois The Civic Federation

When are lake county il property taxes due 2022.

. Lake County collects on average 219 of a propertys assessed fair. Please understand that the Lake. Illinoiss median income is 68578 per year so the median yearly property tax paid by Illinois residents amounts to approximately of their yearly income.

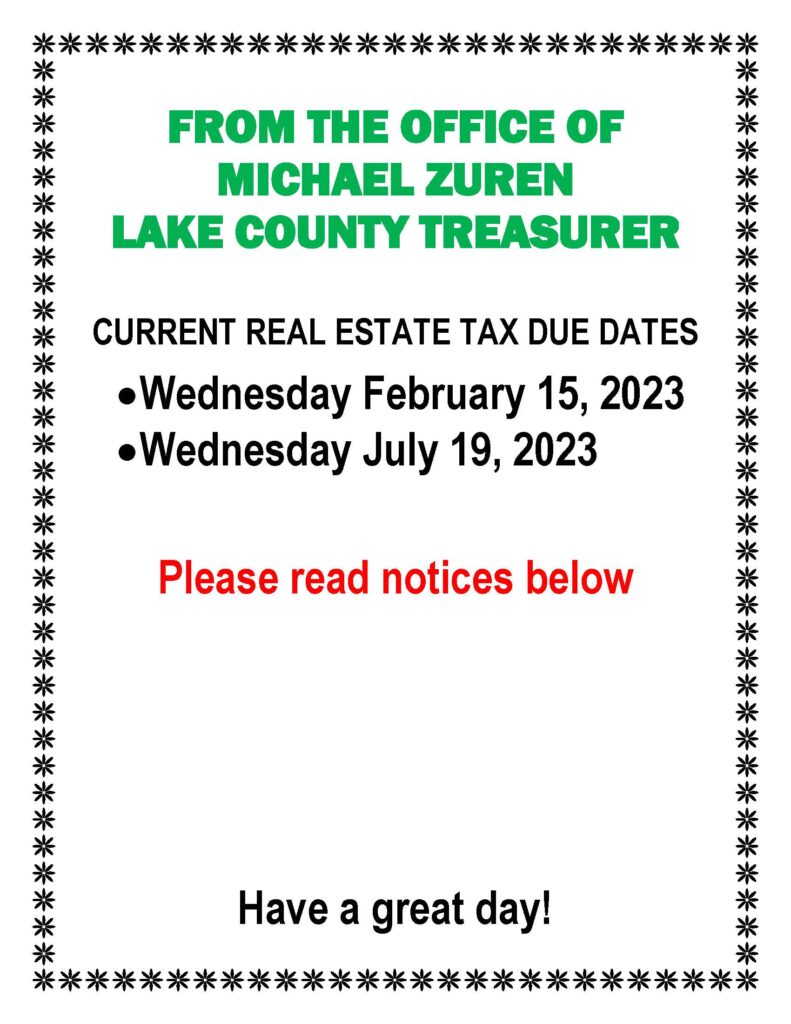

In most counties the property tax is paid in two installments. While taxpayers pay their property taxes to the Lake County Treasurer Lake County. 2019 payable 2020 tax bills are being mailed May 1.

Jul 19 2022. According to the Illinois Compiled Statutes 35 ILCS 20015 the Lake County Collector is bound by state law to collect 15 penalty per month on any unpaid installment balance after the due. Payments should be made by check clearly.

Lake County IL 18 N County Street Waukegan IL 60085 Phone. Unauthorized use and collection of this data may expose the visitor to criminal penalties andor claims for civil damages attorneys fees and costs by Lake County. 847-377-2000 Contact Us Parking and Directions.

Illinoiss median income is 68578 per year so the median yearly property tax paid by Illinois residents amounts to approximately of their yearly income. Lake County Journal. Lake County ranks 18th of the 3143 counties for.

With an average tax rate of 216 Lake County Illinois collects an average of 6285 a year per resident in property taxes. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on. Tax payments may be sent to the Treasurers Office at 200 E.

These real estate taxes are collected on an annual basis by the Lake County Tax Collectors Office. The second installment of the property tax bill is usually. Lake County 18 N County Street Waukegan IL 60085.

In most counties property taxes are paid in two installments usually June 1 and September 1. Center St Madison SD 57042 and MUST be postmarked by October 31. Lake County News Sun.

The year selection in. The Lake County Treasurers Office will be sending notice of the deferred payment plan to Lake County property. If the tax bills are late after May 1 your first installment must be.

50 of the second installment payment is due by Nov. Please understand that the Lake County Tax Offices operate on different years due to the Illinois property tax cycle taking place over a two-year timeframe. Property Taxes Lake County Il In most counties property taxes are paid in two installments usually June 1 and September 1.

The collection begins on November 1st for the current tax year of January through. The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. Lake County collects on average 219 of a propertys assessed fair market value as property tax.

First on June 1 and then on September 1. Contact Us Monday-Friday 830am-500pm Location Google Map Website Disclaimer. Tax Year 2021 Second Installment Property Tax Due Date.

In most counties property taxes are paid in two. The Treasurer sends out tax bills and collects and distributes funds for all Lake County taxing districts. Illinois is ranked 5th of the 50.

Wednesday February 16 2022 Last Day of Payment of 1st Half of 2021 Taxes. For now the September 1 deadline for the second installment of property taxes will remain unchanged. Lake County IL 18 N County Street Waukegan IL 60085 Phone.

Illinois is ranked 5th of the 50. The first installment of Lake County property taxes is due Thursday June 2. If approved by voters the property tax would be 1 for every.

How To Determine Your Lake County Township Kensington Research

Illinois Property Tax Calculator Smartasset

Lake County Illinois Open Data

Lake County Treasurer Office Of Holly Kim

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

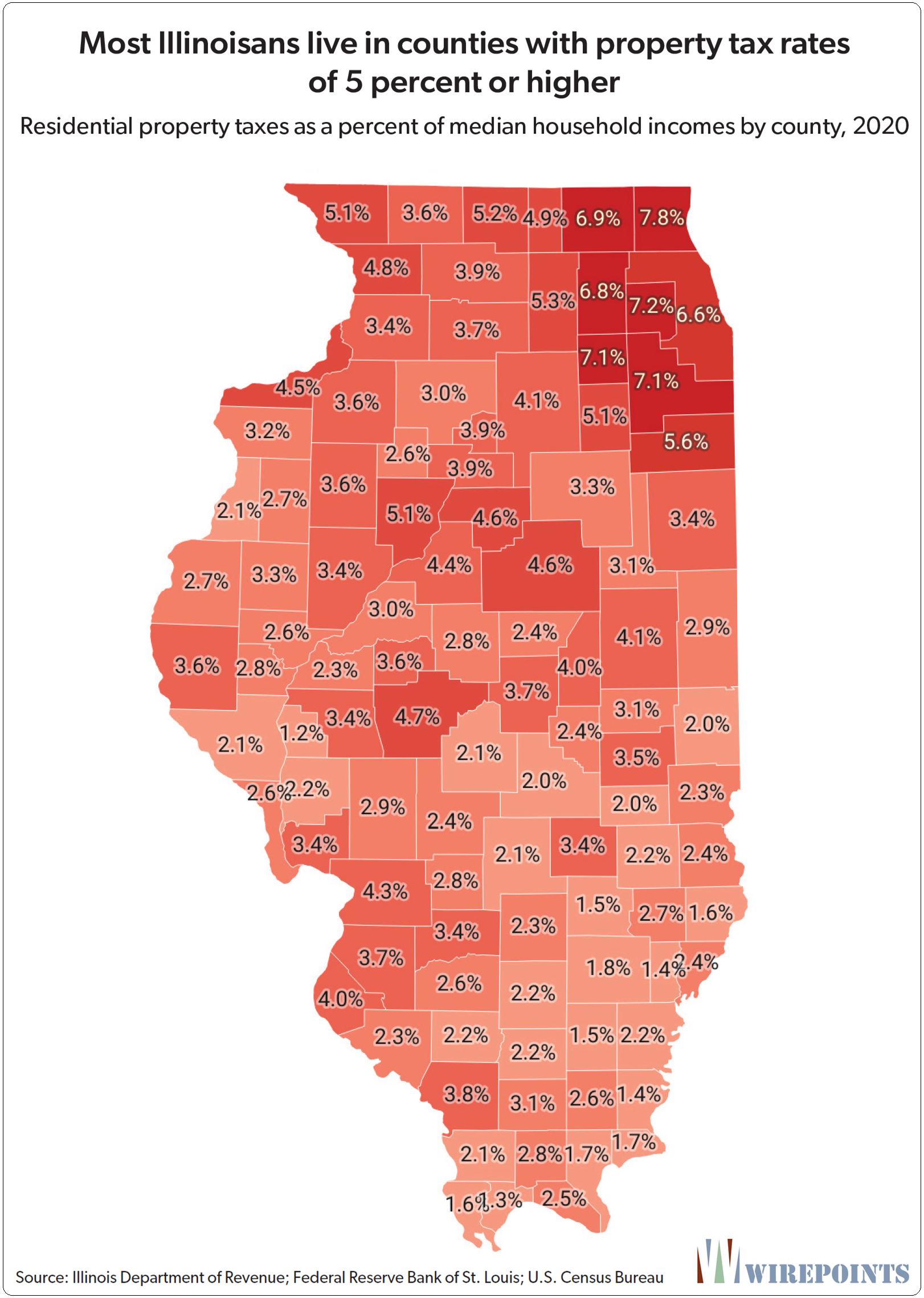

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Lake County Treasurer Office Of Holly Kim

Lake County Il Property Tax Information

Dupage Property Tax Due Dates Fausett Law Office

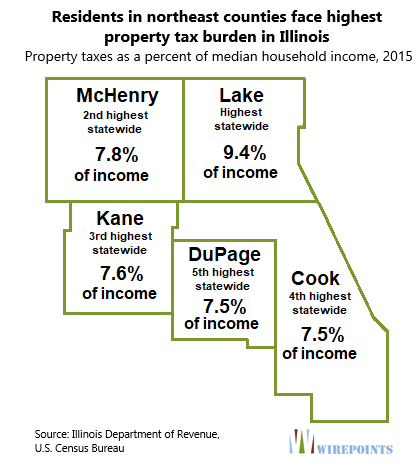

Property Tax Burden In The Chicago Region Cmap

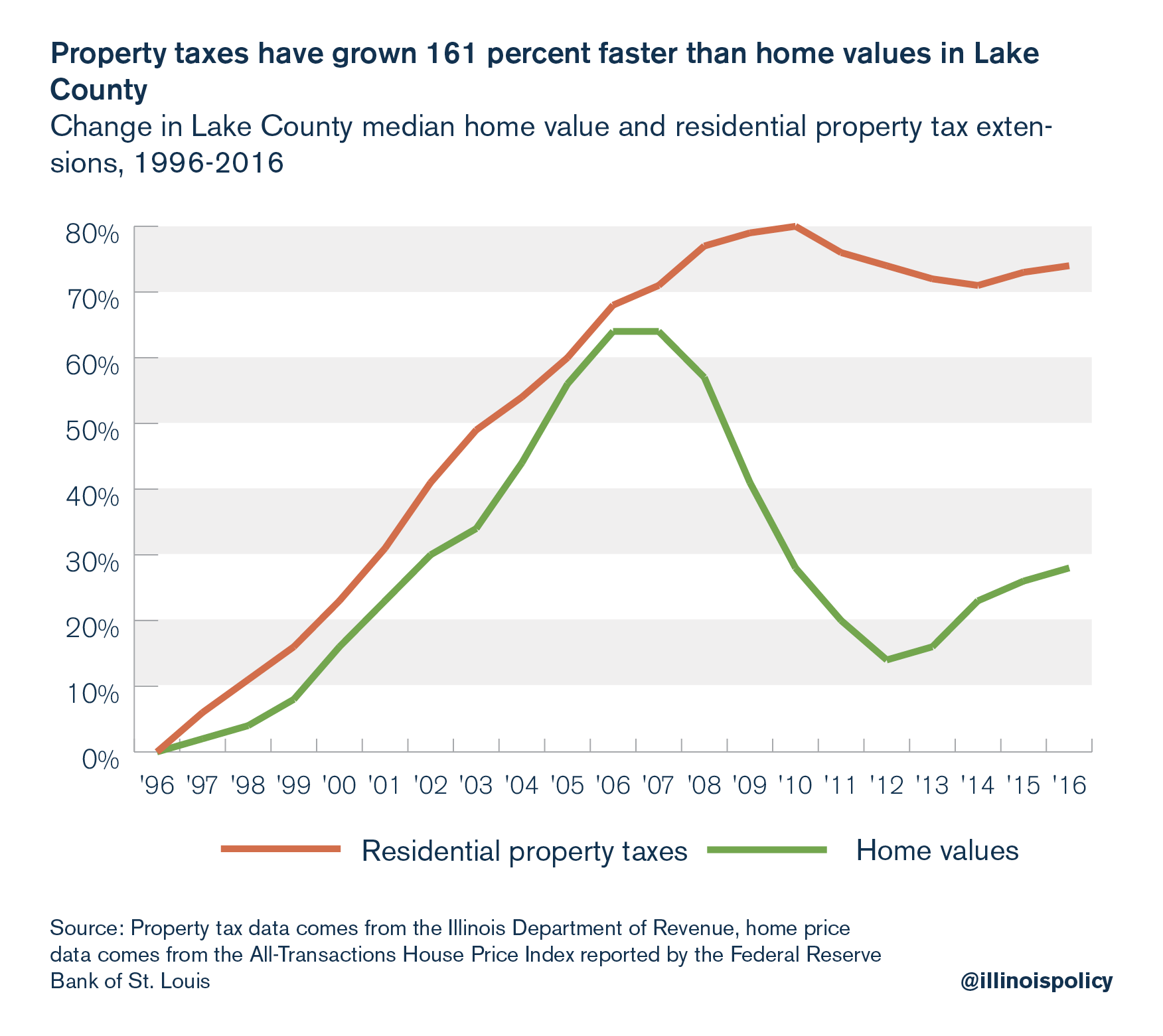

Thirty Years Of Pain Illinoisans Suffer As Property Tax Bills Grow Far Faster Than Household Incomes Home Values Madison St Clair Record

Property Tax Due Dates Treasurer

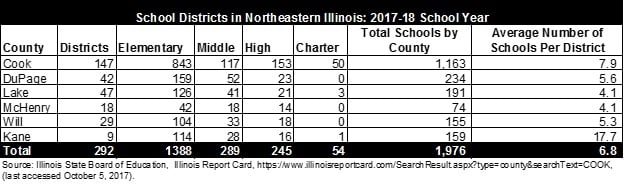

School Districts And Property Taxes In Illinois The Civic Federation

2022 Property Tax Bill Assistance Cook County Assessor S Office

The First Installment Of Property Tax Bills Is Due June 6

Joe Nader 1929 Property Tax Bill Lake Villa Il Illinois County Ephemera Vintage Ebay

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Illinois Lakewood Village Breaks Mold Lowers Property Taxes Wirepoints Original Wirepoints